The Basic Principles Of Pacific Prime

The Basic Principles Of Pacific Prime

Blog Article

Not known Incorrect Statements About Pacific Prime

Table of ContentsThe Definitive Guide for Pacific PrimeSome Ideas on Pacific Prime You Need To KnowThe Ultimate Guide To Pacific PrimeThe 8-Minute Rule for Pacific PrimeSome Known Facts About Pacific Prime.

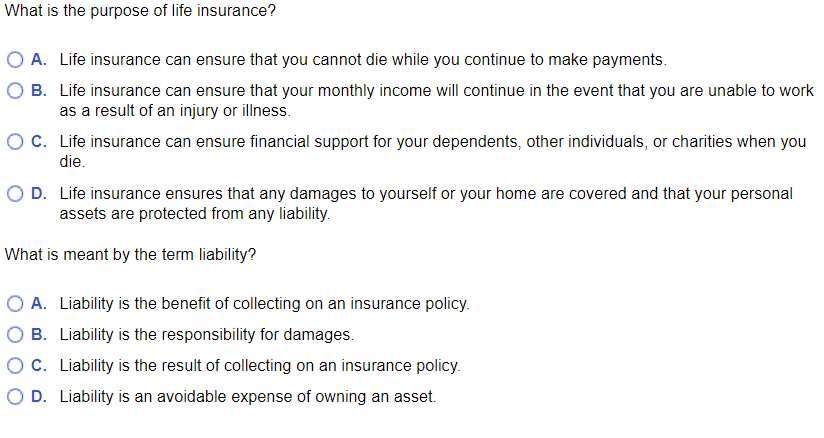

Insurance policy is a contract, represented by a plan, in which an insurance policy holder receives financial security or compensation against losses from an insurer. The company swimming pools clients' risks to pay a lot more economical for the guaranteed. Most individuals have some insurance: for their cars and truck, their residence, their medical care, or their life.Insurance coverage additionally assists cover prices connected with liability (legal duty) for damages or injury caused to a 3rd party. Insurance coverage is an agreement (plan) in which an insurance provider indemnifies one more against losses from particular contingencies or perils. There are numerous sorts of insurance plan. Life, health, property owners, and car are among the most common kinds of insurance coverage.

Investopedia/ Daniel Fishel Numerous insurance plan kinds are readily available, and virtually any individual or service can locate an insurance provider ready to guarantee themfor a cost. Typical personal insurance plan types are car, health and wellness, house owners, and life insurance coverage. The majority of people in the USA contend the very least among these types of insurance, and cars and truck insurance coverage is required by state regulation.

Some Known Incorrect Statements About Pacific Prime

Finding the price that is right for you needs some legwork. The policy limit is the maximum amount an insurance firm will spend for a covered loss under a plan. Maximums might be established per period (e.g., yearly or policy term), per loss or injury, or over the life of the plan, likewise recognized as the lifetime optimum.

Policies with high deductibles are typically less pricey since the high out-of-pocket expense typically causes less tiny claims. There are several kinds of insurance policy. Allow's check out the most crucial. Wellness insurance aids covers routine and emergency situation clinical treatment costs, typically with the choice to add vision and dental solutions independently.

Several preventive solutions may be covered for cost-free before these are met. Wellness insurance coverage may be purchased from an insurance coverage firm, an insurance representative, the government Health Insurance Industry, provided by an employer, or government Medicare and Medicaid protection.

Some Ideas on Pacific Prime You Should Know

As opposed to paying out of pocket for vehicle accidents and damage, individuals pay annual premiums to a vehicle insurance provider. The company after that pays all or most of the protected expenses related to a car crash or other automobile damages. If you have actually a rented car or borrowed cash to purchase a car, your loan provider or leasing dealership will likely require you to bring car insurance.

A life insurance coverage policy assurances that the insurer pays a sum of money to your beneficiaries (such as a spouse or kids) if you die. There are two primary kinds of life insurance.

Insurance policy is a means to handle your economic dangers. When you get insurance coverage, you buy security against unanticipated monetary losses.

The Greatest Guide To Pacific Prime

There are several insurance policy kinds, some of the most common are life, health and wellness, house owners, and automobile. The ideal type of insurance for you will certainly rely on your objectives and financial scenario.

Have you ever before had a moment while checking out your insurance plan or purchasing for insurance policy when you've thought, "What is insurance policy? And do I actually require it?" You're not alone. Insurance can be a mystical and confusing point. Exactly how does insurance policy work? What are the benefits of insurance coverage? And exactly how do you find the finest insurance for you? These are common questions, and the good news is, there are some easy-to-understand solutions for them.

No one wants something negative to happen to them. Suffering a loss without insurance coverage can place you in a hard financial situation. Insurance coverage is a crucial economic device. It can assist you live life with fewer concerns understanding you'll get economic aid after a disaster or accident, helping you recover faster.

Everything about Pacific Prime

And in some cases, like auto insurance policy and employees' settlement, you may be needed by law to have insurance in order to secure others - international health insurance. Learn more about ourInsurance alternatives Insurance policy is basically a massive rainy day fund shared by several people (called policyholders) and taken care of by an insurance policy service provider. The insurance provider utilizes cash collected (called costs) from its policyholders and other investments to spend for its operations and to fulfill its promise to insurance policy holders when they file a claim

Report this page